Many times clients come to us to find a better rate than what their bank is offering when a CD is coming due. Sometimes they are looking for the best short term rate because they fear interest rates are going up and want to have the money available sooner rather than later. Other times they are willing to look at a longer term rate such as five years.

We recently ran some calculations for a client based upon these very scenarios comparing a two to five year CD / fixed rate ladder to chunking into a two year or five year CD / fixed rate annuity or bonds. We compared what happens when interest rates increase, decrease or stay the same.

If we believe interest rates are going down or staying the same we will generally want to find the best rates available to us. The only concern is getting access to the funds when we need them. CD’s and fixed rate annuities provide access to principal when they mature. CD’s typically allow access to the interest they pay and fixed rate annuities typically allow withdrawals of up to 10% per year.

The instances where someone would not want to chunk into the highest interest rate they can find are when they need more than 10% per year from the annuities or the interest available from the CD’s or bonds before maturity or if they are concerned about rising interest rates.

If we are concerned about rising interest rates, laddering a CD / fixed rate portfolio is a great alternative. Laddering is also beneficial to be able to maximize FDIC coverage for CD’s and state insurance protection in the case of annuities. As many are aware, FDIC insurance only covers $250,000 per person, per bank. What others may not be aware of is that many states such as Tennessee and Georgia also cover annuity contracts up to $250,000 and $100,000 respectively for each individual.

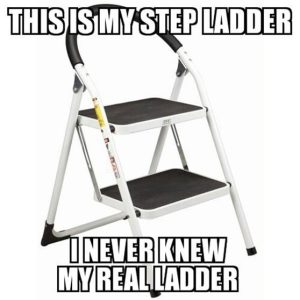

WHAT IS LADDERING?

A CD / fixed rate ladder is a portfolio of CD / fixed rates with maturity dates that are evenly staggered so that a constant proportion of the CD / fixed rates can be redeemed at maturity each year. By holding these to maturity, investors may minimize the potential for losses caused by interest rate fluctuations and the markets. Generally speaking, there are two broad types of CD / fixed rate ladders. One can be implemented more or less perpetually for trusts, endowments, and other applications with extended planning horizons. Another form of CD / fixed rate ladder can be implemented for individuals whose personal financial plans might have a definite endpoint in mind.

Building a ladder provides some certainty, because investors know how much they will earn if they hold to maturity. Laddering is a strategy where investors purchase CD’s and fixed annuities with staggered maturity dates to maximize yield while maintaining scheduled liquidity. When short term CD’s from the low rungs of the ladder mature, the funds are reinvested at the top end of the ladder. As interest rates rise, investors may be able to increase their cash flow by seeking higher yields in longer maturities.

Below is a video explaining this process and an example:

In the wake of the recent economic and market woes, many have repositioned their portfolios into cash equivalents. Certainly this strategy has potential benefits such as preservation of capital, but it also has downsides such as lower potential yields, under pacing of inflation, and limited FDIC coverage. The use of laddered Certificates of Deposits and fixed annuities can be utilized to partially overcome these yield, inflation, and insurance concerns.

Being that longer maturity CD’s and fixed annuities generally have higher yields, staggering the maturity dates provides usually provides a higher overall yield than purchasing one CD every 6 months to two years. (Although relatively rare, a yield curve inversion could potentially cause shorter maturities to have higher yields.) Additionally, with a CD maturing every year, a regular cash influx is created so that investors can potentially capitalize on any new investment opportunities.

Below are links pertaining to FDIC coverage to bank deposits as well as state protections available on insurance products.

https://www.fdic.gov/deposit/covered/categories.html

http://www.tnlifega.org/faq.cfm/

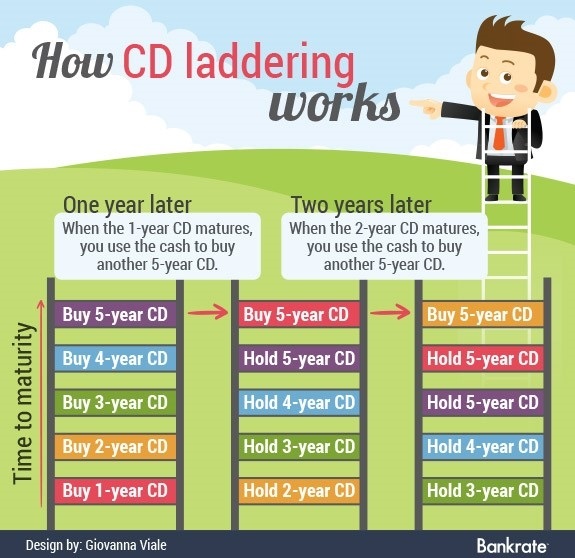

Data as of 6/10/2016

Joe D. Franklin, CFP is Founder and President of Franklin Wealth Management, a registered investment advisory firm in Hixson, Tennessee. A 20+year industry veteran, he contributes guest articles for Money Magazine and authors the Franklin Backstage Pass blog. Joe has also been featured in the Wall Street Journal, Kiplinger’s Magazine, USA Today and other publications.

Important Disclosure Information for the “Backstage Pass” Blog:

Please remember that past performance may not be indicative of future results. Indexes are unmanaged and cannot be invested into directly. Index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investments. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. CD’s are FDIC insured and offer a fixed rate of return if held to maturity. Annuities are not FDIC insured. Annuities are long-term, tax-deferred investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Withdrawals made prior to age 59 1/2 are subject to a 10% IRS penalty tax. Surrender charges may apply. Guarantees are based upon the claims paying ability of the issuing insurance company. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Franklin Wealth Management), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Franklin Wealth Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Franklin Wealth Management is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of Franklin Wealth Management’s current written disclosure statement discussing our advisory services and fees is available for review upon request.